OVERVIEW

Selling insurance in the US is complex. Agents have to deal with endless paperwork, strict licensing laws, and confusing pay systems. We worked with a major InsurTech company to simplify all of this. We built a "digital-first" platform that handles everything an agent needs—from signing up to getting paid—all in one place.

By automating the boring stuff and making numbers easy to see, we've helped agents focus on what they do best: helping people find the right insurance.

The Business Challenge

The Problem

Managing an insurance team was a manual nightmare:

- Signing up new agents took over a week due to paperwork.

- Tracking who works for whom (hierarchies) across states was confusing.

- Calculating commissions and bonuses by hand led to constant disputes.

- Agents had no clear way to see how much they had earned until the end of the month.

The Goal

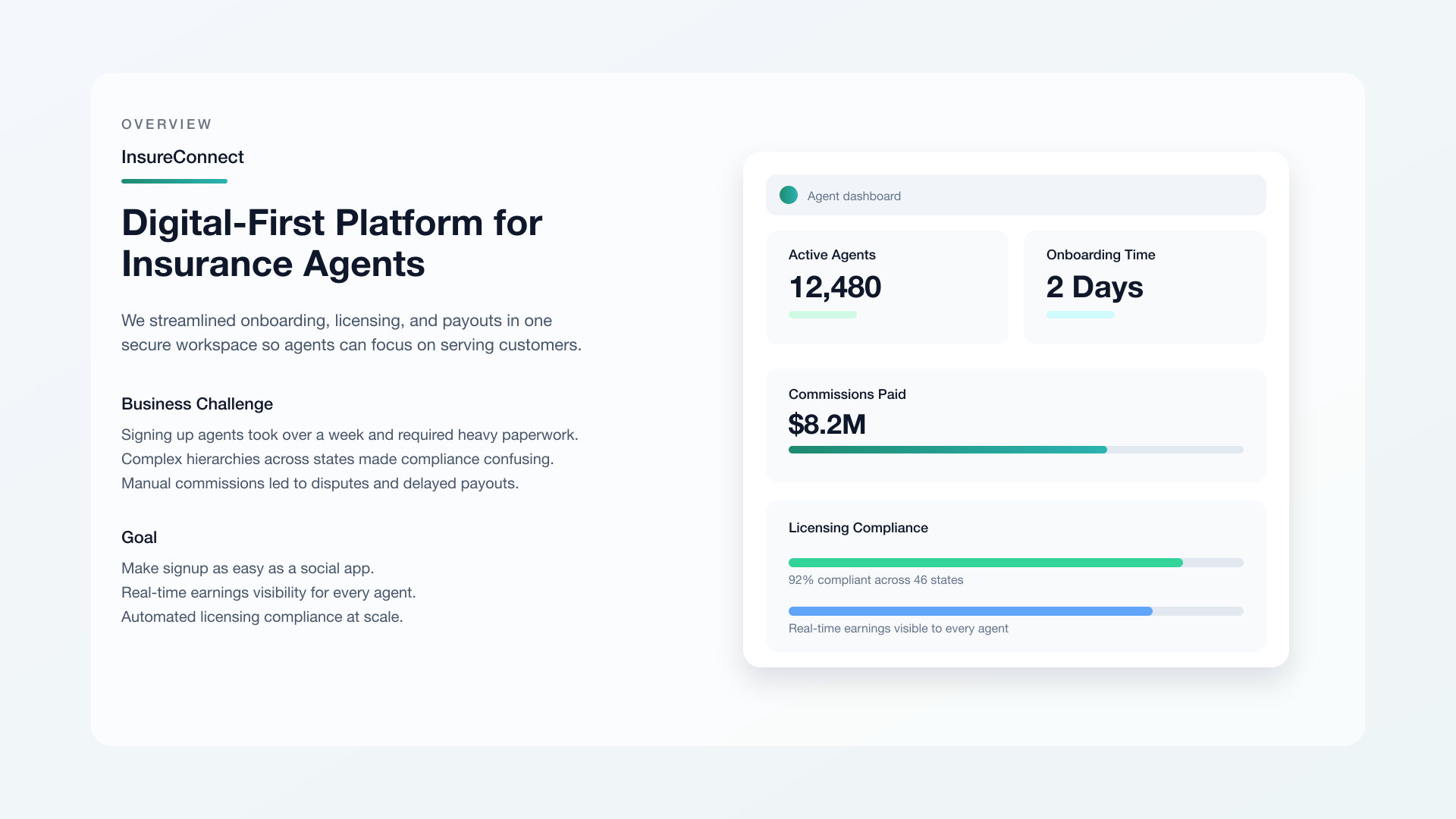

- Make signing up as easy as joining a social media app.

- Create a transparent system where agents can see their earnings in real-time.

- Ensure everyone is properly licensed and follows the rules automatically.

- Scale the business to support thousands of agents without adding more office staff.

The Solution

Automating the Agent Journey

We built a powerful backend system that acts as the "brain" for the entire agency, ensuring data flows correctly from the moment a policy is sold to the moment the payout is released.

Instant Onboarding

Agents now sign up digitally. Licensing and background checks are done automatically in under 24 hours.

Smart Team Management

Managers can easily see their whole team's progress and organize their structure with a few clicks.

Fair & Fast Pay

A rule-based engine calculates every cent of commission instantly, ensuring precise and timely payouts.

Real-Time Visibility

Agents have a dashboard showing daily sales and exactly how much they've earned in bonuses.

The Impact

80% Faster Sign-Ups

Onboarding went from 10 days to just 1 day, allowing the team to grow rapidly.

Zero Pay Disputes

By automating the math, we eliminated payout errors, building massive trust with the agents.

50% Operational Savings

The company now handles thousands of additional agents with the same number of support staff.

Total Transparency

Agents are happier and more motivated because they can see their "leaderboard" and progress 24/7.

Conclusion

This InsurTech platform proves that transparency is the key to trust. By automating the agent lifecycle, we didn't just build software; we created a more efficient way for people to build their insurance careers.

Faster onboarding, accurate pay, and clear goals—that's how technology empowers people to succeed.